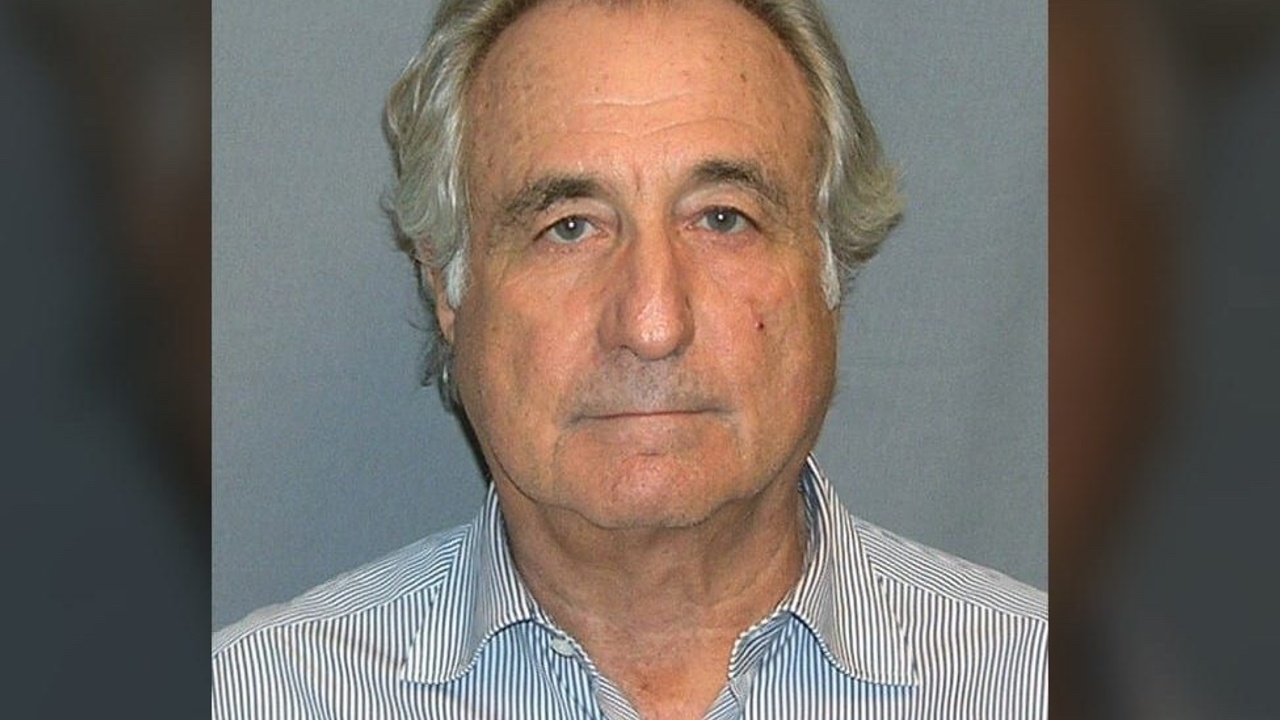

How Bernie Madoff Fooled So Many Smart People

By John Millen

Many people who have been the victims of fraud are reluctant to report the theft, feeling embarrassed that they could be so foolish. They might think that their lack of sophistication made them an easy mark.

But Bernie Madoff, who died this week while serving a 150-year prison term, proved that even the smartest, most sophisticated among us can be conned. Maddoff used a Ponzi scheme, continually taking money from new investors to pay prior investors, to steal tens of billions of dollars.

My friend Brian Ahearn, a persuasion expert, has graciously allowed me to publish this excerpt from his excellent first book Influence People: Powerful Everyday Opportunities to Persuade the are Lasting and Ethical. (I have edited this slightly for space.) Brian provides insights into Madoff's evil use of persuasion, which might help all of us to avoid being victims ourselves:

When I talk about the principles of influence I usually emphasize ethical influence and persuasion; so talking about the unethical use is quite a twist.

The principles of influence tap powerfully into human behavior – what causes someone to say Yes to a request? Social scientists and behavioral economists have studied human compliance and decision making for more than seven decades, so there is plenty of data to back up the effectiveness of principles of influence.

Con men may not know the detailed science, but through trial and error they quickly figure out how to use this psychology to their advantage. It is crucial people understand the principles not only to become more adept at ethically influencing others, but also to avoid being manipulated by con men such as Bernie Madoff.

Let’s go through how Madoff used each principle to continually bring in new investors – for decades! After all, Ponzi schemes depend on a continued inflow of investors and money or else they quickly collapse, so landing new clients was of the utmost importance for Madoff.

Reciprocity – We feel obligated to give back to those who first give to us. When someone does us a favor we want to return the favor in some way and silly as it may sound, Bernie made it seem like he was doing his clients a favor by letting them invest with him.

After all, his clientele were the rich and famous, he’d been a glowing success for decades and was well respected. For most it was a privilege to let him handle their money. The favor was returned as people told other wealthy investors about Madoff so new clients continually came by way of referral.

Liking – People like to do business with people they like, especially those who are similar to them. Madoff tapped into this principle based on similarities with many of his clients. For starters, he recruited from his country club. That’s not out of the ordinary at all because men gauge one another’s character a lot based on what they have in common, like a love of golf.

Unity – Unity says it’s easier for us to say Yes to people who are of us; those with whom we have a shared identity. In addition to liking, Madoff tapped into unity through his Jewish heritage. Many of his victims were Jewish and trusted him more based on this shared identity.

Consensus – We feel more comfortable doing what everyone else is doing or doing whatever people just like us are doing. If you’re rich then it’s very likely you hang out with people who are also rich.

Inevitably conversation turns to business so undoubtedly Madoff’s name was passed around like the offering plate at church. If you know many of your most successful friends invest with someone, that’s going to give you comfort to consider the same investment advisor.

Authority – People tend to trust those who are viewed as experts and Bernie had this one down! He’d been investing successfully (theoretically!) since the early 1960s. Even more impressive: Bernie helped start the NASDAQ. His trustworthiness seemed impeccable because he also served as board chair for the National Association of Security Dealers. Why wouldn’t you automatically trust him with those credentials on his side?

Consistency – We like to be consistent in what we say and do. When you do something you typically do it because you believe it’s the right thing to do. If someone asks who you invest with you’ll probably talk glowingly about your advisor.

Being the con man he was, I’m sure Madoff occasionally asked his biggest clients for referrals and recommendations, which they were probably all too willing to give. After all, it would be inconsistent not to.

Scarcity – People want more of what they cannot have or something that’s hard to come by. Not just anyone could pick up the phone and call Madoff. The supposed size (billions and billions) made it appear to be a very exclusive club.

However, the more exclusive its appearance, the more people wanted in. How would you feel if you knew a business only took on a limited number of new clients each year, and you were one of the few they were considering? People jumped at the chance!

That’s a quick overview of the psychology Bernie used to gain investors and facilitate massive theft. Hindsight is 20/20 so maybe we think we’d never be fooled in such a way.

However, the kinds of people who invested with him – the rich and famous – were smart, successful and well educated. The reality is we’re all susceptible because we’re human, and the same unethical tricks he played may have worked with us.

How can you DEFEND yourself against unethical influence tricks? Here’s my advice: continue to learn about influence, keep your eyes and ears open, and most of all, learn to trust your gut because when something seems too good to be true, it usually is.

Photo Credit: U.S. Department of Justice

Reinventd features products and services we trust. Some of the featured products may provide us with referral commissions at no additional cost to readers.